| News repertory |

|

The origins of Venture Studios

The concept of venture studios is not a recent innovation. To trace its origins, we need to rewind to 1996 in Silicon Valley, where the incubator Idealab, founded by Bill Gross, serves as the genesis of this idea. Bill Gross launched Idealab with the vision of creating a modern version of Thomas Edison’s laboratory, a space where he could explore ideas and subsequently transform them into distinct companies. These companies would operate with their own management teams and funding while benefiting from shared experiences and resources. Remarkably, Idealab remains operational, boasting an impressive track record of 150 startups created and over 50 IPOs to its name after 25 years of existence[1].

Timeline

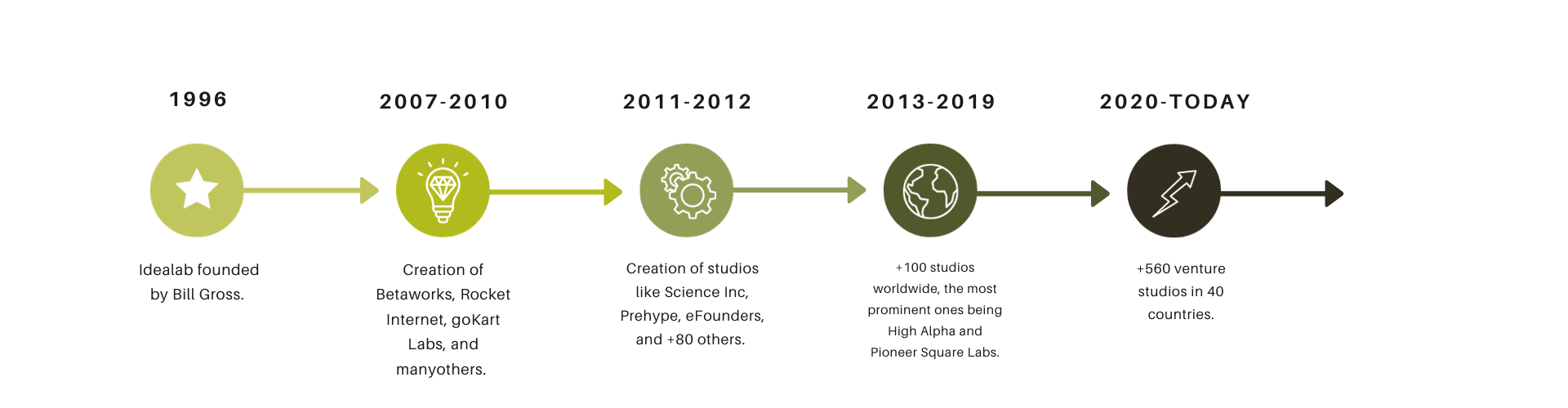

It took several years for this model to disseminate to other organizations. In the late 2000s, In the late 2000s, successful technology entrepreneurs who, like Bill Gross, wanted to find a way leverage their expertise in business creation while simultaneously pursuing multiple startup ideas in parallel, rather than concentrating on a single venture. Their desire was to focus exclusively on the initial phase of this process (exploring and experimenting with new business models and launching new startups). The venture studio model emerged as the obvious solution. According to the Global Startup Studio Network, the evolution of venture studios can be categorized into three distinct waves of development[2].

Source : ENHANCE White paper

The first wave unfolded between 2007 and 2010, marked by the establishment of entities like Betaworks, Rocket Internet, goKart Labs, and a few others. Betaworks, in particular, played a pivotal role in bringing this concept of studios into the post-dot-com bubble era as a legitimate business creation model.

However, it was during the second wave (between 2011 and 2012) that the concept experienced its true growth, with the emergence of studios like Science Inc, Prehype, eFounders, and more than 80 others.

Source : https ://publishizer.com/startup-studio-playbook/

Today, we find ourselves in the third wave, which is believed to have started between 2013 and 2019 wich, to date, witnessed the creation of hundreds of studios worldwide, with the most prominent ones being High Alpha and Pioneer Square Labs. The IPO of Snowflake in 2020, a company originating from Sutter Hill Ventures, brought the spotlight to the venture studio model[3]. According to certain sources, there are currently over 560 venture studios across 40 countries, representing an astounding growth rate of 625% between 2013 and 2021[4]. North America accounts for over 50% of the venture studios landscape, but there is a substantial surge in interest and growth in Europe. In fact, some sources suggest that, on average, a new studio is established every month. Consequently, the venture studio model is not only emerging but also exceptionally dynamic.

CHECK OUT THE OTHER ARTICLES IN THIS SERIES :

Why did we decide to create a dossier on venture studios?

The concept of venture studio, also known as a startup studio, startup foundry, or venture builder, is rapidly gaining traction in the world of venture capital, and Quebec is no exception. While discussing this concept with members of Réseau Capital, we recognized that this unique model, which combines both startup creation and funding, can contribute as a complementary force to strengthen critical elements within the financing value chain. These elements include deal flow, talent acquisition, the involvement of corporations in venture capital, talent circulation, and research commercialization. All of which currently significant challenges to Quebec’s funding ecosystem.

Through some research, we discovered that Quebec has a thriving community of studios, many of which, in our humble opinion, are well-kept secrets. Thus, we decided to shed light on these homegrown Québec studios. Over a series of articles, we will delve into the landscape of these organizations, explore the opportunities inherent in this model, and introduce the individuals and entities that have embraced it.

We would like to thank Gilles Duruflé and Sébastian Boisjoly from Station FinTech for their collaboration on this series of articles.