| News repertory |

|

A Simple Guide to Drafting Your ESG Manual: Understanding its Significance for Your Firm’s Future (Part 1)

Before we start

ESG vs. Impact

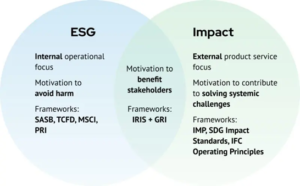

Impact and ESG are two different concepts that overlap. You also probably heard about responsible investing. Let’s untangle them.

While ESG is a measure of risks and opportunities related to ecological, social and governance factors in an investment decision, Impact and Responsible Investing are on a spectrum of investment theses that go from traditional investing (where a Fund seeks financial returns, regardless of ESG factors) to philanthropy (where financial returns are disregarded in favour of social and environmental solutions).

Responsible investing is about screening out based on ESG risks you want to avoid (think not investing in the tobacco, alcohol, weapons, or pornography industries). Most generalist funds in Canada fall into that category.

Sustainable investing is about considering ESG factors as investment opportunities that are favourably considered when making investment decisions (for example considering a firm that is great at reusing or recycling its products as a more interesting opportunity than its competitors).

Thematic Impact investing and Impact First investing are what most people would refer to as Impact Funds. The first targets industries or societal challenges (for example cleantech investing) while also considering financial returns when making investment decisions, and the latter has ESG considerations take precedence over financial returns and will invest in riskier, more innovative companies that drive societal change.

Source : Graph retrieved from Technically Philly

ESG Standards and Frameworks

ESG standards primarily focus on internal operational issues within a business, including areas like workforce diversity, energy consumption, and waste management. They are often motivated by the desire to avoid harm, such as mitigating risks. In contrast, impact measurement centers on the external effects of an organization’s products or services on customers and the world. It includes measures related to healthy product usage, reductions in greenhouse gas emissions, and improvements in stakeholders’ social outcomes. Impact efforts are generally driven by the goal of contributing to solutions, like addressing social or environmental challenges.

Source : https://impactentrepreneur.com/esg-and-impact/

How to: Writing your ESG Manual

In the following series of content, we’ll go over each section of an ESG Manual, and explain the key questions and discussions to have to align the partnership team around guiding principles that will help you draft your ESG Manual.

1. Defining ESG and DEI for Your Firm

The first part of your ESG Manual should include how your firm defines the E, the S and the G of ESG. While broad definitions can be similar amongst firms, you might want to add your interpretation and define where each factor starts and ends according to your investment firm. Before delving into the specifics of drafting an ESG Manual, it’s essential to define the core concepts:

Environmental (E): These factors assess a firm’s impact on the environment, including its carbon footprint, resource management, and commitment to sustainable practices. Questions to consider:

- What do you consider to be environmentally friendly?

- What are the factors you would consider when making an investment decision in a cleantech company?

- Are you interested in investing in B-Corp-certified companies? In Cleantech companies?

- Which overlap does your investment thesis have with environmentally-driven business models?

Social (S): Social factors encompass how a firm interacts with its employees, communities, and customers. They encompass diversity and inclusion (DEI), labour practices, and community engagement. Questions to consider:

- What are some of the businesses we could invest in that have a social purpose (eg. EdTech, HRTech focused on equality etc.)?

- What are some of the minimal criteria we expect companies we invest in to meet? What are some of the policies and practices we would ask startups to implement post-investment?

- What are some of the practices and processes we are proud to have at the firm, and would like portfolio companies to learn from?

- What social challenges do you wish to improve thanks to your investments (education, equity, healthcare…)?

Governance (G): Governance factors pertain to the firm’s leadership, ethics, and transparency. They include board composition, executive compensation, and adherence to ethical business practices. Questions to consider:

- Are you contributing to building diverse and independent boards for your portfolio companies?

- How do you wish your portfolio companies implement strong governance structures to prevent unethical behaviour?

- Do you consider that some elements should be made transparent to shareholders when investing in a company?

- Which elements should be made transparent to your Limited Partners to ensure good governance?

Diversity, Equity and Inclusion (DEI): This is a vital aspect of the “S” in ESG. It focuses on ensuring team and management diversity, equality of chances and inclusivity within the firm. Questions to consider:

- How do you define diversity, and which types of diversity do you strive to improve within your team? Within your portfolio companies?

- What are some of the barriers you wish to overcome by opening doors for groups that have historically been marginalized?

- Have you set any goals and objectives for your Firm to become more inclusive for all? For your portfolio companies?

- How are your practices and processes ensuring bias-free investment decisions? Hiring and promotion decisions?

- What KPIs do you measure to ensure all minority groups feel engaged at work?

2. What Does ESG Mean for Us

In the landscape of modern business, Environmental, Social, and Governance (ESG) considerations have emerged as a transformative force, shaping not only investment decisions but also the way companies and startups operate. Crafting a clear and comprehensive “What Does ESG Mean for Us” section in your ESG Manual is a crucial step in communicating your commitment to ESG values. We’ll guide you through the process of creating a compelling section that reflects your firm’s understanding of ESG and its impact on your operations. By following these insights, you can effectively engage with other investors, employees, portfolio founders and stakeholders, demonstrating your expertise and commitment to a sustainable future.

Consider organizing it based on the following categories:

Defining ESG for Your Firm:

Articulate how you perceive ESG in the context of your organization. This could involve explaining the importance of environmental responsibility, social impact, and sound governance practices when making investments. Some Funds will invest in companies that have a social impact more than an ecological impact. Including common definitions is important, but it’s also key to discuss with the partnership team how the portfolio reflects what you consider important ESG factors when making investment decisions.

Example from Atomico’s ESG Policy

As of the date of this ESG Policy, Atomico currently includes the following factors within our definition of ESG:

- Environmental factors: the pollution and contamination of land, air and water, and related legal and regulatory compliance; eco-efficiency; waste management; management of scarce natural resources; climate change impacts; biodiversity; and the development of new technologies, products and markets e.g. ‘green’ / sustainable products and services.

- Social factors: the treatment of employees including their pay; health and safety; labour conditions; human rights; any form of discrimination, harassment or victimization; diversity and inclusion, supply chain management; and the treatment of all stakeholders including customers and communities.

- Governance factors: anti-bribery and corruption measures; business ethics; accountability; transparency; conflicts of interest; whistle-blowing; control mechanics; and the governance of environmental and social factors.

Alignment with Core Values:

If you have defined Firm values, highlight the alignment between your Firm’s core values and ESG principles you want to adopt and see portfolio companies adopt. Translating your values into how it relates to social, ecological and governance principles will help make things more tangible and create alignment between ideology and guiding principles when making investment decisions or drafting internal processes and policies.

Example from Atomico’s ESG Policy

Atomico (UK) Partners LLP (“Atomico”) and the funds which it advises have a mission to build the world’s most prosperous, sustainable, diverse, inclusive and mission-driven technology ecosystem in Europe.

Atomico firmly believes that great companies can come from anywhere and that entrepreneurs are the gamechangers for a better world. Our purpose is to invest in companies that return profits but also create returns for society.

ESG is at the core of Atomico’s investment philosophy, purpose and values. We recognise the integral role that ESG issues have on the success of our investments (both positive and negative) and we also recognise that, given the wide-reaching impact that some of our portfolio companies can have, venture capital firms such as ourselves are in a unique position to bring lasting change in the world. We want the businesses we invest in to be genuinely focussed on doing well for all stakeholders including their own employees, customers, suppliers, shareholders, the environment and the wider world at large. We firmly believe that responsible business practices help generate superior long-term performance.

Integration into Strategy:

Detail how you plan to integrate ESG considerations into your operations and how it aligns with your investment thesis. Explain how ESG will influence areas such as team development, possible expansion into other industries in future funds, how ESG supports market trends you’ve been seeing and how following clear ESG principles can be beneficial for your portfolio companies.

Example from Atomico’s ESG Policy

For Atomico, ESG is not just a screening process. The partners and investment teams at Atomico take an active interest in how our portfolio companies manage ESG issues and actively encourage, support and stretch our portfolio companies to strive for the very best ESG standards.

Key Components and Checklists

Defining ESG for your firm:

- Clarity: Ensure that your definition of ESG is clear, concise, and tailored to your firm’s values and thesis.

- Relevance: Identify the specific ESG factors that hold the most significance for your team and LPs.

- Context: Provide context by explaining why ESG matters to you and how it addresses relevant challenges you’re seeing in the market.

Alignment with Core Values:

- Consistency: Demonstrate the alignment between your ESG commitments and your Firm’s established mission and values.

- Employee Engagement: Think about how your practices and processes align and reflect your ESG principles.

Integration into Strategy:

- Strategy Mapping: Clearly map out how ESG considerations will be integrated into different aspects of your investment thesis.

- Long-Term Vision: Describe how ESG considerations contribute to your long-term vision and growth.

Recommended Resources

Lors de la rédaction de la section “Que signifie l’ESG pour nous”, tirez parti de ces ressources pour enrichir votre compréhension et raffiner votre approche :

- https://medium.com/@hello_23899/how-to-write-an-esg-policy-for-a-vc-fund-a-practical-guide-1969e7a5f32b

- https://iimpcoll.com/content/how-to-write-an-esg-report-step-by-step-guide

- https://www.linkedin.com/advice/0/how-do-you-include-esg-your-deal-sourcing-skills-venture-capital

- https://bigsocietycapital.com/latest/impact-and-esg-in-venture-capital-getting-the-basics-right-and-pushing-forward/

In an age where ESG considerations are integral to business success and sustainability, a well-defined “What Does ESG Mean for Us” section is essential. By asking critical questions and structuring your section thoughtfully, you can effectively communicate your understanding of ESG to investors, employees, and portfolio companies. We believe that transparent communication of ESG values is a cornerstone of building a firm that focuses on what is important for them, while creating alignment between actions and values. We encourage you to embrace this opportunity and demonstrate your dedication to creating positive environmental, social, and governance impact. Our partner Cap Inclusive can help you dive into this project.

Discover other articles from this guide :

This content series is aimed at guiding investors in drafting their ESG Manual. While an ESG Policy is a legal document that should be revised by your legal team, an ESG Manual sets the intentions for how a Firm will align its thesis and values with ESG guiding principles and reporting standards. Lastly, drafting an ESG Manual implies aligning the team and all managing partners around a shared vision and understanding of what ESG means for a Fund that isn’t an Impact Fund.

This content series is aimed at guiding investors in drafting their ESG Manual. While an ESG Policy is a legal document that should be revised by your legal team, an ESG Manual sets the intentions for how a Firm will align its thesis and values with ESG guiding principles and reporting standards. Lastly, drafting an ESG Manual implies aligning the team and all managing partners around a shared vision and understanding of what ESG means for a Fund that isn’t an Impact Fund.